Resume Ace Website

Ace your interviews !!

Make your resume innovative like you

Resume Ace lets you create a professional resume in less than

15 minutes. All you need to do is enter basic details about yourself,

we’ll help you with the rest.

Resume Ace lets you create a professional resume in less than

15 minutes. All you need to do is enter basic details about yourself,

we’ll help you with the rest.

You no longer have to worry about how to make a resume.

Our resume generator will guide you through the process of

writing each section, step-by-step. Resume writing tips will

help you get more job offers.

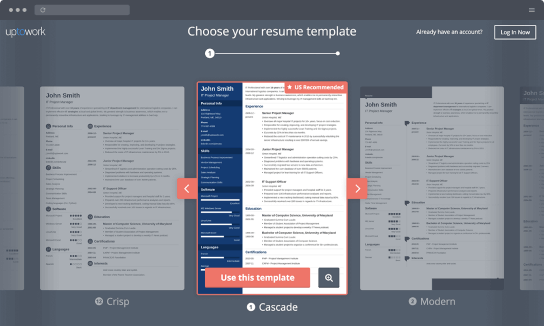

Choose professional, elegant, creative, or modern

resume templates. Resume Ace offers 18 templates.

You can easily change colors and adapt the layout

to any resume format you choose: functional,

reverse-chronological, or

combination.

The Goods and Services Tax is a unified, multi-stage, and consumption-based tax levied on the supply of goods or services, combining all stages such as manufacture, sale and consumption of goods and services. It functions at a national level in order to replace most of the national and state tax systems like VAT, service tax, excise duty, etc. It removes the cascading effect of tax-on-tax, earlier prevalent. It is applicable to you if you are into manufacturing, trading, e-commerce or providing services, and your annual turnover exceeds a prescribed limit.

You can enrol for GST via the common portal of the Goods and Services Tax. ClearTax can also help you with your enrollment. For more details, click here.

Yes, a person with multiple business verticals in a state may obtain a separate registration for each business vertical (in each state).

Small businesses and taxpayers with a turnover of less than Rs.1.5 crore (Rs.75 lakh for special category states) can opt for the composition scheme where they will be taxed at a nominal rate of 0.5% or 1% (for manufacturers) CGST and SGST each (rates as per the latest proposed changes in the Goods and Services Tax bills). Composition levy is available to only small businesses dealing in goods. It is not available to interstate sellers, e-commerce traders and operators, and service providers.

The input tax credit refers to the amount of tax on purchases that you can reduce at the time of paying tax on sales. One of the fundamental features of the Goods and Services Tax is the seamless flow of input credit across the chain (from the time the goods are manufactured until it is consumed) and country.